The acquisition of Esso Gás in 1953 marks the beginning of the Lorentzen Group’s operations in Brazil. Taking advantage of an opportunity to expand his family’s enterprises, Erling Lorentzen bought Exxon gas distributor in Brazil, starting a success story of over six decades.

Subsequently named Gasbras, the company merged with Supergas in 1968. The new company was then renamed Supergasbras and achieved strong growth by multiplying its client portfolio and market value. The proceeds from its sale in 1972 enabled the Lorentzen Group to make important new investments.

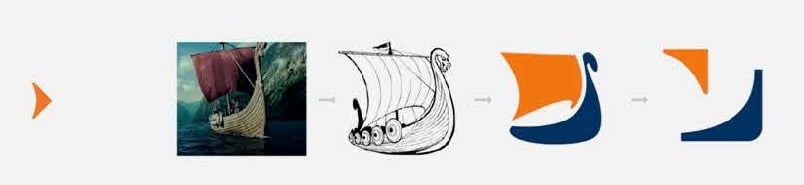

The foundation of Companhia de Navegação Norsul and Aracruz Florestal occurred earlier in the 1960s. Following Lorentzen family’s original talent, Norsul became the largest private dry bulk carrier along Brazil’s coast, in addition to carrying liquid bulk.

Lorentzen Group’s operations in the chemical-industrial sector developed between 1976 and 2000, in a partnership with Norway’s Elkem, to whom it ended up selling its holdings in Carboindustrial and Carboderivados.

Aracruz represents an important milestone not only for the Lorentzen Group, but also for Brazil and the world’s pulp industry. Featuring high-performance and leadership in the segment of high-yield eucalyptus forests, the company is the world’s largest producer of bleached pulp. Aracruz was the first Brazilian company listed on the New York Stock Exchange and the only forestry company in the world to participate in the Dow Jones Sustainability Index from the very start.

After more than 30 years managing Aracruz Celulose, in 2008 the Lorentzen Group sold its shareholdings to Votorantim Group. That company held its position as world leader in the production of eucalyptus pulp, now under the name of Fibria.

Lorentzen Group’s activities have been growing since 2006, when Aflopar was founded. In 2009, Lorinvest was created with the task of managing the Group’s investments and funds, starting a new development cycle.

With hard work, determination, focus on innovation and high profitability, the Lorentzen Group built a reputation for integrity throughout its history, based on transparency and accountability.